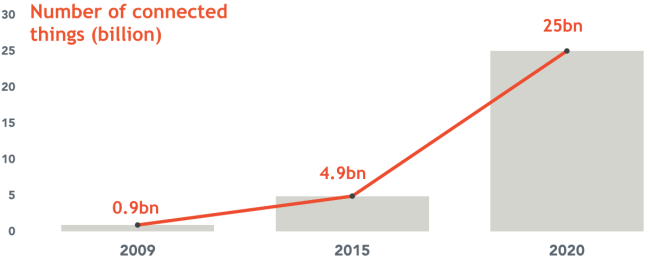

In part one of this blog, I discussed the potential impact of an exponential growth of connected devices, in terms of today’s software licenses.

However, the Internet of Things is already bringing a different licensing challenge. An ever-increasing number of smart devices are being brought to home, street and workplaces. As with many rapid technical revolutions, the focus has been on innovation and market growth. Monetisation has been a secondary concern. Reality, however, has to catch up in time, and now we are seeing a number of blogs and articles (such as this example from Wired’s Jerome Buvat) debating how IoT vendors might actually start to make some money back.

So why does this matter to Software Asset Managers?

In April 2014, Gartner published a research paper, aimed at IoT vendors, entitled “Licensing and Entitlement Management is One of the Keys to Monetizing the Internet of Things“. Its author, Lawrie Wurster, argued strongly that vendors should see IoT devices not so much as hardware assets, but as platforms for software:

“…to secure additional revenue, manufacturers need to recognize the role that embedded software and applications play in the IoT, and they need to monetize this value”

Gartner point out a number of big advantages for vendors:

- New offerings can be created with software enhancements, increasing speed to market and removing the expensive retooling of production lines.

- A single license can bundle hardware, feature offerings and supporting services such as consulting.

- Vendors can create tiered offerings, enabling the customer to start with basic levels of capability, but with the possibility to purchase more advanced features as they mature.

- Offerings can be diversified. The vendor can create specific regional offerings, or niche solutions for specialist markets, without needing to manufacture different hardware.

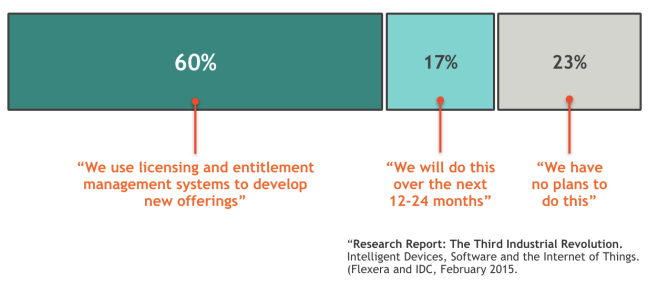

This is not merely analyst speculation, though. It is already happening, and there are already vendors like Flexera helping to enable it. Flexera are a well known name to software asset managers (and my employer, BMC, works in close partnership with them in the SAM space), but another significant part of their business is the provision of licensing frameworks to vendors. This year, they co-published a report with IDC which presented some striking findings from a survey of 172 device vendors

- 60% of the vendors are already bundling a mixture of device, software and services into licenses:

- 32% already use software to enable upsold options. More than half will be doing this by 2017.

- 27% already use a pay-per-use model, charging by the amount of consumption of the software on the devices. A further 22% plan to do so by 2017.

While there are clear advantages, both to vendors and consumers, there is a big unspoken challenge here. With licensing comes the difficulty of license management. This is not something that industry has done well even before the smart device revolution: Billions of dollars are paid annually by enterprises in compliance settlements.Many ITAM functions depend heavily on automated discovery of software installed and used on devices. However, today’s discovery tools may not adapt to discovering multiple new classes of IP-connected devices. Even when the devices are visible, it may not be easy to detect which licensed options have been purchased and enabled.

Another big challenge might arise from a lack of centralisation. The growth of smart devices will be seen right across the business: in vehicles, facilities, logistics, manufacturing, even on the very products the company itself is selling. With software, the IT department typically had some oversight, although even this has been eroding (SkyHigh Networks, for example, now put the average number of cloud services in an enterprise at over 900… and it’s likely that a significant number of these were bought outside IT’s line of sight). Put bluntly: IT may simply have no mandate to control purchasing of licensed devices.

This puts the IT Asset Management function in an interesting position. Software Asset Management and Hardware Asset Management, traditionally seen as two related but separable personas, are going to converge when it comes to smart devices. More widely, businesses may need guidance and support, to learn the lessons from IT’s previous difficulties in this area, and avoid even greater compliance and cost-sprawl problems in future.